The History of Cyclical Macroprudential Policy in the United States

Published: May 15, 2013

This paper presents a survey and historical narrative of policies to smooth the credit cycle in light of their potential future application as “macroprudential” policies to reduce the build-up of risks in U.S. financial markets. (Working Paper no. 13-08)

Abstract

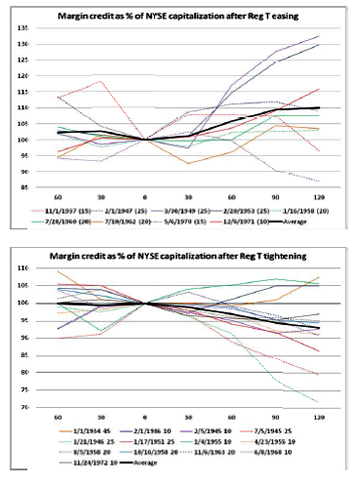

Since the financial crisis of 2007-2009, policymakers have debated the need for a new toolkit of cyclical “macroprudential” policies to constrain the build-up of risks in financial markets, for example, by dampening credit-fueled asset bubbles. These discussions tend to ignore America’s long and varied history with many of the instruments under consideration to smooth the credit cycle, presumably because of their sparse usage in the last three decades. We provide the first comprehensive survey and historic narrative of these efforts. The tools whose background and use we describe include underwriting standards, reserve requirements, deposit rate ceilings, credit growth limits, supervisory pressure, and other financial regulatory policy actions. The contemporary debates over these tools highlighted a variety of concerns, including “speculation,” undesirable rates of inflation, and high levels of consumer spending, among others. Ongoing statistical work suggests that macroprudential tightening lowers consumer debt but macroprudential easing does not increase it.

Keywords: Macroprudential policy; financial stability; credit cycles; regulation; Federal Reserve history; credit controls JEL codes: E32, E44, E63, E65