More Transparency Needed For Bank Capital Relief Trades

Published: June 11, 2015

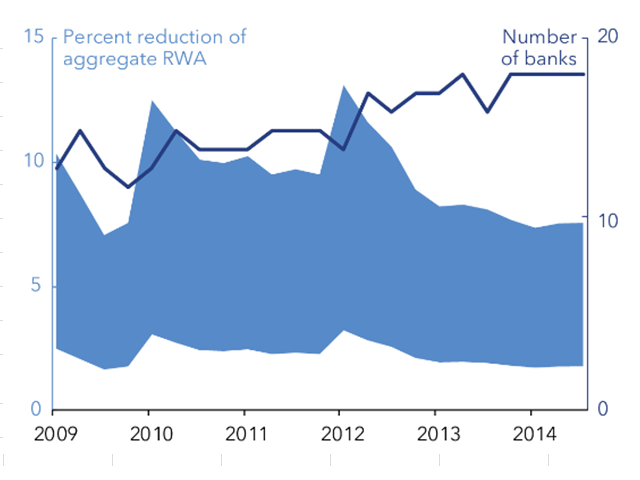

This brief argues that more data are needed to allow investors and counterparties to assess how banks reduce their required regulatory capital by transferring credit risk to third parties. The authors use public regulatory data to show that 18 banks purchased $38 billion in credit protection as of Q4 2014 to obtain regulatory capital relief. They also estimate the impact of these transactions on banks’ risk-based capital ratios. (Brief no. 15-04)