Negative Rates in Bilateral Repo Markets

Published: September 27, 2021

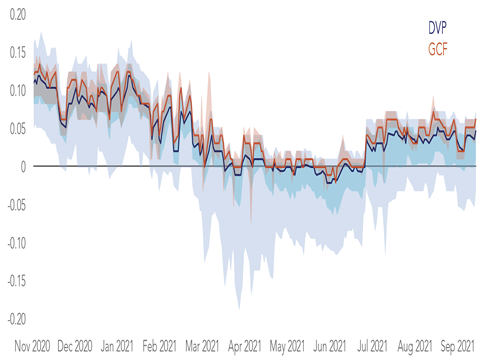

Interest rates on repurchase agreements (repo) are crucial indicators of conditions in financial markets. This brief discusses negative rates in bilateral repo markets during 2021, and shows that they stemmed from two key sources: (1) broad factors that pushed down general collateral repo rates, and (2) narrower factors that pushed bilateral repo rates below comparable tri-party general collateral rates. Broad factors include increases in bank reserves and decreases in the supply of close alternatives to repo in early 2021. Narrower factors primarily concern demand for specific collateral in the bilateral market. Finally, the brief examines the effects of negative rates on the Secured Overnight Financing Rate (SOFR) and shows the existing construction of the SOFR successfully limits the impact of specific collateral demand on the reference rate. (Brief no. 21-03)