The Sell-off in Long-term Bonds

Published: May 21, 2015

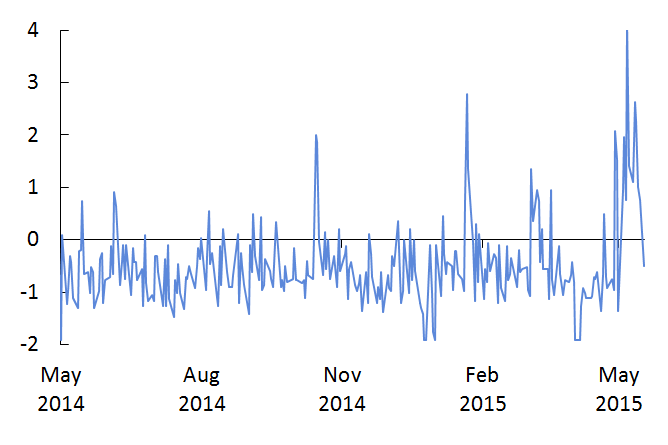

Over the last month, long-term euro area bonds experienced a sharp sell-off, leading to outsized moves in other major global bonds, including U.S. Treasuries. The sell-off reflects a partial unwinding of the euro area “QE trade,” in which investors established sizable positions in euro area bonds, equities, and the euro in response to the European Central Bank’s expanded asset-purchase program.

Developments during the last month

- The unwinding of the euro area “QE trade” drove sizable price moves in the euro area: bonds and equities sold off sharply and the euro reversed more than half of its 2015 depreciation

- The rise in long-dated euro area bond yields triggered large, correlated moves in other major bond markets

- The broad U.S. dollar index depreciated as the euro regained ground

- Outside of Europe, major equity indices were generally range-bound; U.S. equities remain at record high levels

- Oil prices continue to rebound, but remain about 40 percent below their 2014 peaks

- Greece’s government financing situation remains unresolved and a source of risk for broader euro area markets