Market Sentiment Deteriorates Following China’s Currency Devaluation

Published: August 24, 2015

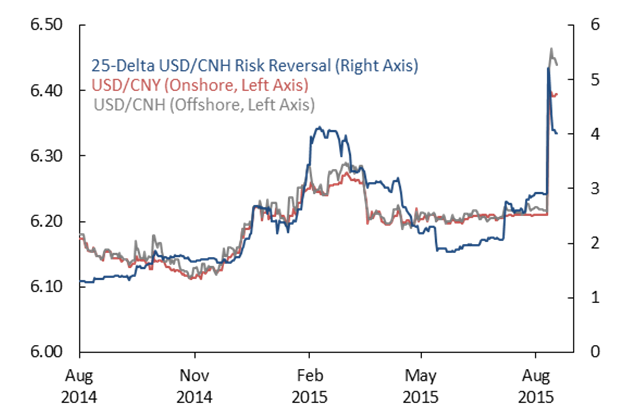

Risk aversion intensified in August following China’s surprise renminbi devaluation and its shift toward a more market-oriented currency regime. The currency moves magnified market concerns about slowing global growth and inflation, causing pronounced sell-offs in markets for commodities, emerging market currencies, and global equities.

Recent developments:

- China devalued its currency and announced plans to establish a more market-based currency regime.

- Commodity prices, global equities, and emerging market currencies came under significant pressure on concerns that a weakening Chinese economy could diminish global growth.

- The growth concerns and market turbulence have reduced expectations for the Federal Reserve to begin raising interest rates in coming months. The market-implied probability of a rate hike in 2015 is now about 50 percent.

- Puerto Rico’s Public Finance Corporation defaulted on an August debt payment, but with little spillover to broader municipal debt markets.

- Market concerns about Greece receded as its government reached an agreement with other euro area governments for a new financial support program.