Yields On Money Market Fund Investment Holdings Of Repos By Tenor

Rates

Interest rates measure the cost of funding. They can act as indicators both of short-term costs of capital for financial intermediaries and of stress in funding markets. These charts present interest rates across various short-term funding markets and types of funding.

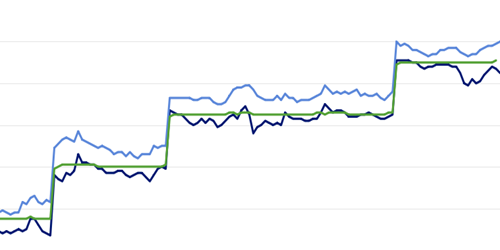

Yields on money market fund investment holdings of repos by tenor

Dollar-weighted median yields on money market investment fund holdings of repos by tenor

Skip the ChartMoney market funds are a type of mutual fund used for cash management by institutional and retail investors. As a group, these funds are the largest cash lenders in short-term funding markets. Money market funds provide liquidity to the markets. This liquidity allows issuers of short-term debt securities, such as corporations and governments, to roll over their financing.

This chart shows the dollar-weighted median yield on money market funds investments in repurchase agreements (repo) by tenor, which is the amount of time between the initial trade of cash for securities and the repurchase of those securities. Money market funds adjust the term of their investments both to match expected fund redemptions and to take advantage of expected interest rate movements. Because funds are the largest cash lenders in repo markets, a shift in their maturity preference affects the trading volume and the interest rate charged in these markets. A change in the spread between yields

of different tenors can indicate the relative demand for financing on different maturity terms from dealers and other counterparties.

Series Used

This OFR monitor is presented solely for informative purposes and should not be relied upon for financial decisions; it is not intended to provide any investment or financial advice. If you have any specific questions about any financial or other matter please consult an appropriately qualified professional. The OFR makes no warranty, express or implied, nor assumes any legal liability or responsibility for the accuracy, completeness, reliability, and usefulness of any information that is available through this website, nor represents that its use would not infringe on any privately owned rights.

Disclaimer Regarding Non-OFR Data and InformationFor convenience and informational purposes only, the OFR may provide links and references to nongovernment sites. These sites may contain information that is copyrighted with restrictions on reuse. Permission to use copyrighted materials must be obtained from the original source and cannot be obtained from the OFR or from the U.S. Treasury Department. The OFR is not responsible for the content of external websites linked to or referenced from this site or from the OFR web server. The U.S. government, the U.S. Treasury Department, the Financial Stability Oversight Council, and the OFR neither endorse the data, information, content, materials, opinions, advice, statements, offers, products, services, presentation, or accuracy, nor make any warranty, express or implied, regarding these external websites. Please note that neither the U.S. Treasury Department nor the OFR controls, and cannot guarantee, the relevance, timeliness, or accuracy of third-party content or other materials. Users should be aware that when they select a link on this OFR website to an external website, they are leaving the OFR site.

Suggested CitationOffice of Financial Research, “OFR Short-term Funding Monitor,” refreshed daily, https://www.financialresearch.gov/short-term-funding-monitor/ (accessed ).