When Choosing Counterparties, Banks Tend to Pick Riskier Ones

Published: September 29, 2022

By Dasol Kim, Research Principal, Office of Financial Research and Andrew Ellul, Visiting Fellow, Office of Financial Research and Professor of Finance and Fred T. Greene Chair in Finance at Indiana University’s Kelley School of Business

In a recent working paper analyzing who banks chose as counterparties in the over-the-counter (OTC) derivatives market, the authors found that banks are more likely to choose riskier nonbank counterparties that are already heavily connected and exposed to other banks, which leads to an even more densely connected network. Furthermore, banks do not hedge these exposures, but rather increase them by selling rather than purchasing credit derivative swaps against these counterparties. Finally, the authors found that common counterparty exposures are correlated with systemic risk measures despite greater regulatory oversight following the 2008 financial crisis.

What are the primary conclusions?

The authors looked at risk-taking by banks as demonstrated by choice of their nonbank counterparties. The analysis focused on how these choices in the OTC derivative markets contribute to network fragility. The authors found:

- Systemically important banks have a greater propensity to choose counterparties with a higher degree of existing connections to other systemically important banks. In densely connected networks, banks are more likely to connect with risky counterparties for their most material exposures. Moreover, the results are resilient to alternative explanations related to counterparty demand factors and changes in the regulatory environment.

- While banks could hedge their credit risk exposures to interconnected counterparties, mitigating the potential impact, if these counterparties were to fail, they often do not. In fact, they double-down on these exposures by selling insurance against those counterparties. This behavior is most pronounced in riskier counterparties.

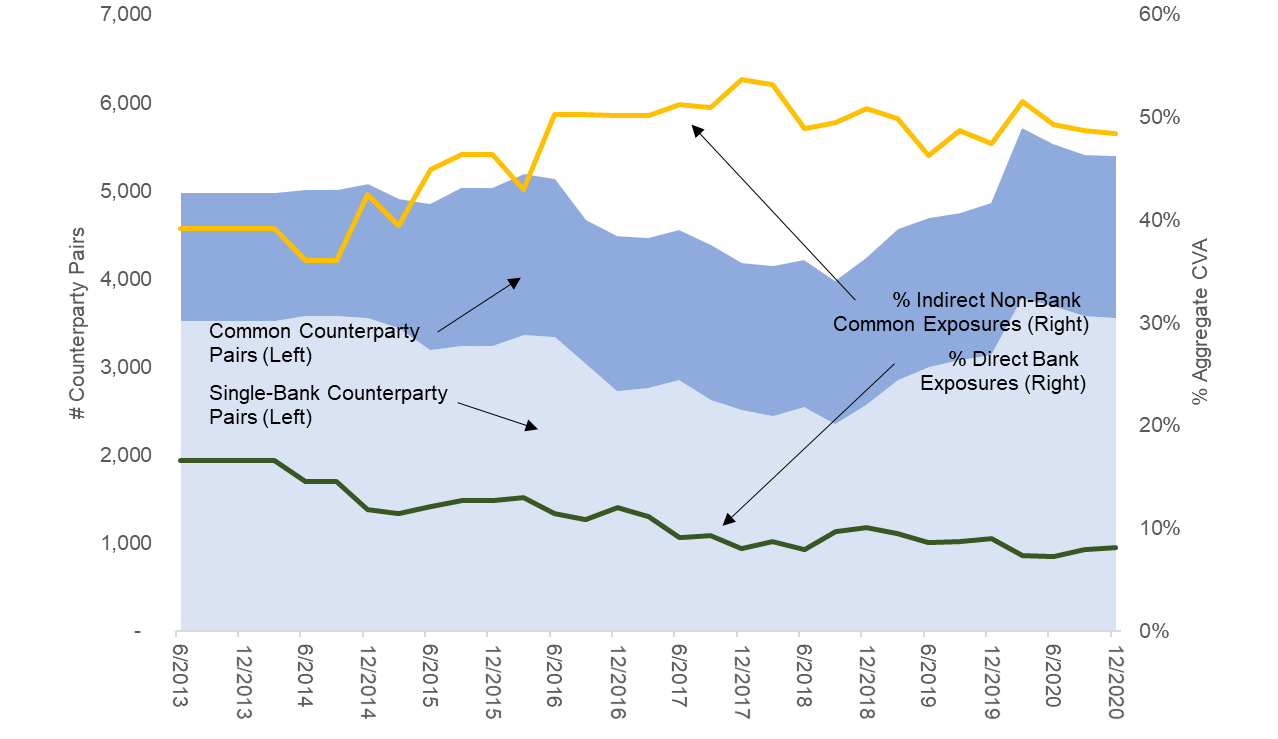

- Regulatory reforms, such as uncleared margin rules and mandatory clearing, were designed to reduce risk by mitigating the build-up of dense interconnections and systemic feedback. The paper shows that the density of financial market networks has actually increased following the adoption of these reforms in the bilateral derivatives markets. Moreover, interconnectedness due to shared counterparty exposures has a significant association with systemic risk measures in the post-crisis period.

What are the financial stability implications?

The question about counterparty choice is central to our understanding of the financial system’s resilience to contagion. The impact of adverse external shocks may be amplified for networks already weakened by riskier connections. Additionally, a system may come under pressure from a network-intrinsic risk rather than an exogenous shock and counterparty risk is one way this could happen.

Network connections and choice of counterparties is especially important in the derivative markets. Uncleared derivatives account for approximately half of all derivative activities by banks, making them a significant fraction of their trading operations overall. Half of these are represented by nonbank counterparties with multiple bank dealers. Losses on uncleared derivatives are fully borne by the bank, whereas losses for cleared derivatives are mutualized across member firms of the clearinghouse.