Systematic Scenario Selection: Stress Testing and the Nature of Uncertainty

Published: February 7, 2013

This paper offers a technique for selecting multidimensional shock scenarios for use in financial stress testing. The technique uses a grid search of sparse, well distributed stress-test scenarios that are considered a middle ground between traditional stress testing and reverse stress testing. (Working Paper no. 13-05)

Abstract

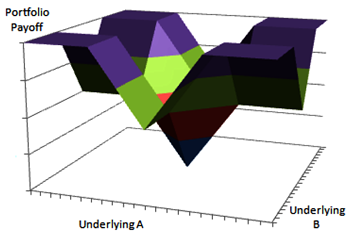

We present a technique for selecting multidimensional shock scenarios for use in financial stress testing. The methodology systematically enforces internal consistency among the shock dimensions by sampling points of arbitrary severity from a plausible joint probability distribution. The approach involves a grid search of sparse, well distributed, stress-test scenarios, which we regard as a middle ground between traditional stress testing and reverse stress testing. Choosing scenarios in this way reduces the danger of “blind spots” in stress testing. We suggest extensions to address the issues of non-monotonic loss functions and univariate shocks. We provide tested and commented source code in Matlab®.

Keywords: risk management, stress testing, maximum portfolio loss, elliptical distribution, value at risk, Knightian uncertainty

Attachment: