A Map of Funding Durability and Risk

Published: May 29, 2014

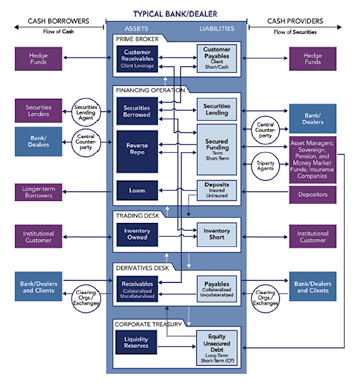

This paper features a funding map to illustrate the flow of funding from its initial providers through the bank/dealers to the end-users. In addition to showing the plumbing of the system, the paper also shows the processes for transforming funding liquidity, credit quality, and tenor. The paper then applies the funding map to track risk through various types of financial institutions, and to identify gaps in data needed for financial stability monitoring. (Working Paper no. 14-03)

Abstract

The dynamics of the financial system and the undercurrents of its vulnerabilities rest on the flow of funding. Analysts typically represent these dynamics as a network with banks and financial entities as the nodes and the funding links as the edges. This paper focuses instead on the funding operations within the nodes, in particular those within Bank/Dealers, adding a critical level of detail about potential funding risks. We present a funding map to illustrate the primary business activities and funding sources of a typical Bank/Dealer. We use that map to trace the paths of risk through four specific financial institutions during historical crises and to identify gaps in data needed for financial stability monitoring. We also introduce the concept of “funding durability,” defined as the effective term of funding in the face of signaling and reputational considerations during periods of stress. Using these tools, the paper highlights the points of potential durability mismatch and resulting funding risks within the Bank/Dealer. It also provides insight into how funding weaknesses can pass from one institution to another and ultimately affect financial stability.

Keywords: Collateral, funding liquidity, repo, funding map, funding mismatch, financial stability