Gauging Form PF: Data Tolerances in Regulatory Reporting on Hedge Fund Risk Exposures

Published: July 30, 2015

This paper examines the precision of Form PF, a regulatory filing introduced after the financial crisis to measure risk exposures for private funds, including hedge funds. The paper finds that Form PF’s measurement tolerances are large enough to allow private funds with dissimilar risk profiles to report similar risk measurements to regulators. (Working Paper no. 15-13)

Abstract

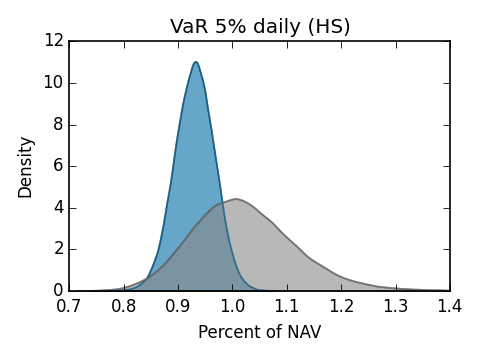

This paper examines the precision of the U.S. Securities and Exchange Commission’s Form PF as an instrument for measuring market risk exposures in the hedge fund industry. We introduce a novel methodology that systematically presents the measurement instrument, Form PF, with a range of simulated portfolios with observable characteristics. We assess the measurement tolerances of Form PF by examining the range of actual market risk exposures — measured directly from portfolio details — that are consistent with a given, fixed presentation on the form. We find that Form PF’s measurement tolerances are sufficiently large to allow private funds with dissimilar actual risk profiles to report similar risks to regulators. We also find that the form’s stratification by value at risk (Form PF Question 40) helps significantly to narrow the measurement tolerances.

Keywords: Hedge funds; Form PF; data quality; risk monitoring