The Life of the Counterparty: Shock Propagation in Hedge Fund-Prime Broker Credit Networks

Published: October 1, 2019

This paper shows the post-crisis hedge fund-prime broker credit network is concentrated among 10 percent of participants. The average fund borrows from three brokers, and the brokers lending the most are highly connected. The paper finds that a liquidity shock to a prime broker results in reduced borrowing by hedge funds due to the broker reducing its supply of credit. Larger, more connected, and better-performing funds, and those that do less over-the-counter trading, are better able to compensate for the reduction in credit from the broker. (Working Paper no. 19-03)

Abstract

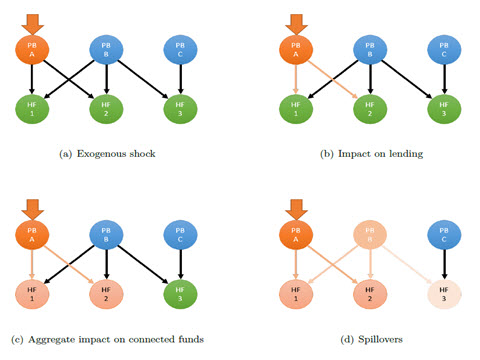

The collapse of Lehman Brothers illustrated the importance of managing prime broker counterparty risks for hedge funds. Liquidity shocks to prime brokers can lead to cycles of deleveraging that produce losses at funds and potentially have harmful effects on financial market function and credit provision. While the hedge fund-prime broker credit network is highly concentrated, the average hedge fund in our sample borrows from three prime brokers and has a total credit exposure of $2.15 billion. We show that hedge fund borrowing tends to be overcollateralized and most of the collateral is allowed to be rehypothecated. Using a within fund-quarter empirical strategy, we identify the effects of an idiosyncratic liquidity shock to a major creditor. Such a shock results in significantly reduced borrowing due to the prime broker reducing credit supply instead of a precautionary reduction in credit demand from connected hedge funds. Borrowing by funds with more rehypothecable collateral is less affected because such collateral improves the constrained creditor’s liquidity situation. Even large hedge funds simultaneously borrowing from multiple creditors see a significant reduction in their aggregate borrowing following the shock. Larger, more connected and better-performing hedge funds and those that do less OTC trading are better able to compensate for this loss.