Cross-Asset Market Order Flow, Liquidity, and Price Discovery

Published: October 23, 2019

This paper examines the complex intra-day linkages between the U.S. equity securities market and the equity derivatives market. The paper finds a positive, but short-lived, relationship between the two markets’ order flow activities, which relate to the supply, demand, and withdrawal of liquidity between the two markets. The paper also finds that cross-asset market order flow is a key component of liquidity and price discovery, particularly during periods of market volatility. (Working Paper no. 19-04)

Abstract

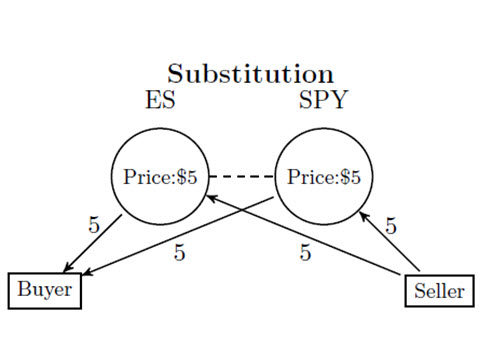

Cross-asset market activity can be a channel through which illiquidity risks originating in one market can propagate to others. This paper examines the complex intra-day linkages between the U.S. equity securities market and the equity derivatives market using high-frequency data on S&P 500 index exchange-traded funds and E-mini futures contracts. The paper finds a positive, but short-lived, relationship between the two markets’ order flow activities, which relates to the supply, demand, and withdrawal of liquidity between the two markets. The paper also finds that cross-asset market order flow is a key component of liquidity and price discovery, particularly during periods of market volatility.