Leverage and Risk in Hedge Funds

Published: February 25, 2020

This paper examines the relationship between hedge funds’ use of leverage and their portfolio risk. It finds that more leveraged funds tend to have less volatile returns and less chance of an extreme negative return. More leveraged funds also tend to hold higher quality and more liquid assets. (Working Paper no. 20-02)

Abstract

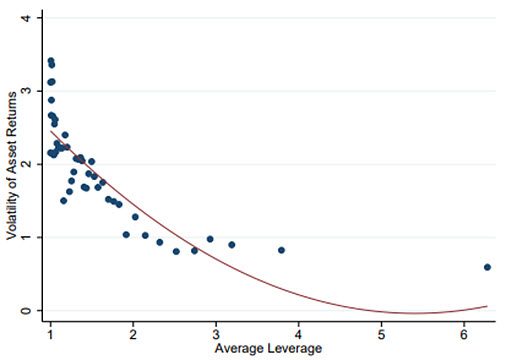

The use of leverage is often considered a key potential systemic risk in hedge funds. Yet, data limitations have made empirical analyses of hedge fund leverage difficult. Traditional theories predict leverage and portfolio risk are positively linearly related. Alternatively, an emerging wave of theories of leverage constraints predict leverage and asset risk are negatively correlated, and therefore leverage and portfolio risk may be unrelated or even negatively related. Consistent with theories of leverage constraints, we find that hedge fund leverage and portfolio risk are weakly negatively correlated. This arises from a strong negative association between leverage and asset risk — in particular, market beta. The average market beta on funds’ assets explains 20% of the cross-sectional variation in hedge fund leverage, and 47% for the subsample of equity-style funds. Also consistent with these theories, leverage and portfolio alpha are strongly positively related, but this relationship is

entirely explained by market beta. Our findings suggest that the association between leverage and risk in hedge funds is nuanced, and that leverage is in part used to scale the payoffs of low-beta, high-alpha securities, resulting in an essentially flat relationship between leverage and portfolio risk. Keywords: Hedge Funds, Leverage, Systemic Risk, Financial Stability, Low Beta Anomaly

JEL Classifications: G11, G12, G23