Are Short-selling Restrictions Effective?

Published: October 11, 2023

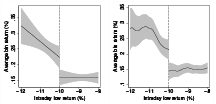

Despite strong predictions based on theories of disagreement, limited empirical evidence has linked short-selling restrictions to higher prices. We test this relationship using quasi-experimental methods based on Rule 201, a threshold-based policy that restricts aggressive short selling when intraday returns cross −10%. When comparing stocks on either side of the threshold in the same hour of trading, we find that the restriction leads to short-sale volumes that are 8% lower and daily returns that are 35 bps higher. These price effects do not reverse after the restriction is lifted.

Abstract

Despite strong predictions based on theories of disagreement, limited empirical evidence has linked short-selling restrictions to higher prices. We test this relationship using quasi-experimental methods based on Rule 201, a threshold-based policy that restricts aggressive short selling when intraday returns cross −10%. When comparing stocks on either side of the threshold in the same hour of trading, we find that the restriction leads to short-sale volumes that are 8% lower and daily returns that are 35 bps higher. These price effects do not reverse after the restriction is lifted.

Keywords: short selling, uptick rule, securities regulation, Rule 201, short-selling restrictions

JEL Classifications: G12, G14, G18