Do Credit Default Swaps Still Lead? The Effects of Regulation on Price Discovery

Published: July 17, 2024

This paper studies how regulation implemented after the Global Financial Crisis has impacted price discovery in the credit default swap (CDS) market. The author finds that CDS spreads incorporate less private information prior to rating decreases and adjust more slowly after such events. Single name CDS spreads also lead their corporate bond counterparts more weakly following margin reforms that only affect derivatives markets (Working Paper 24-04).

Abstract

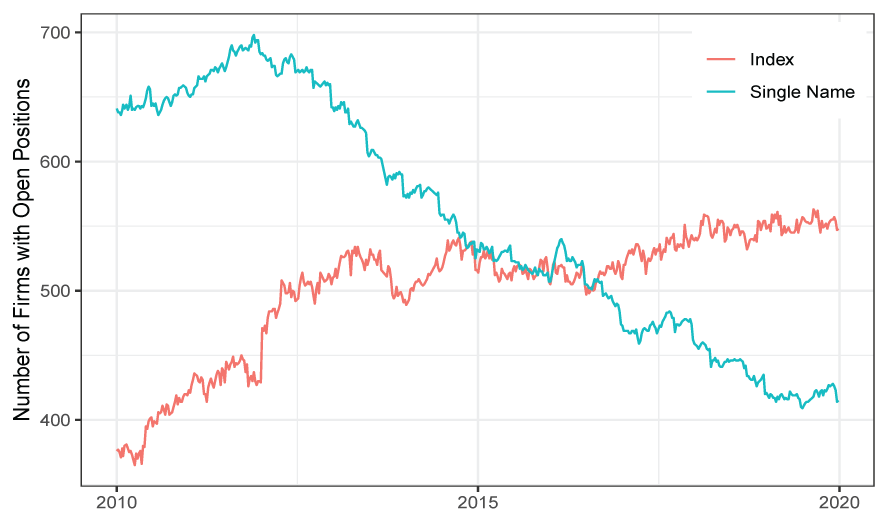

This study explores whether reforms implemented since the Global Financial Crisis have affected the price discovery process for corporate credit by altering the primacy of CDS over corporate bonds and credit ratings. I develop a model that demonstrates an increase in the relative cost of trading individual securities reduces agents’ incentive to acquire information and drives them toward index products. Empirically, single-name CDS incorporate less information prior to rating decreases following post-crisis reforms that makes these instruments costlier to trade. Furthermore, CDS spreads lead corporate bond spreads more weakly after the adoption of margin requirements that affect only derivatives.