Central Clearing and Trade Cancellation: The Case of LME Nickel Contracts on March 8, 2022

Published: December 10, 2024

Mass trade cancellation is a novel and poorly understood tool for risk management, introduced by the LME during an episode of nickel market stress in March 2022 and upheld in subsequent court decisions. This working paper describes how trade cancellation was used to mitigate margin demands on market participants with already depleted liquid resources and considers these powers more generally. It argues that trade cancellation powers lie in tension with an important function of CCPs, which is to ensure contract performance. The adverse consequences of the use of these powers may reduce the incentives of CCPs to prevent episodes of default from occurring (Working Paper no. 24-09).

Abstract

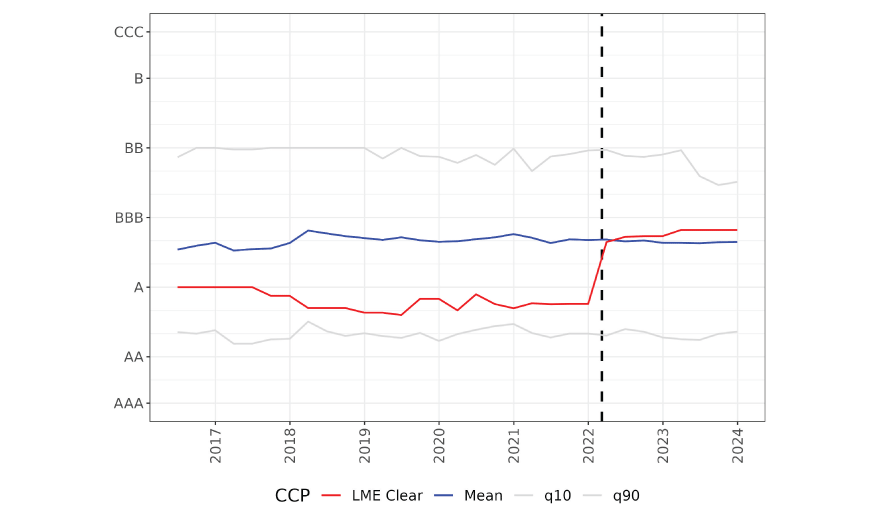

In March 2022, nickel prices on the London Metal Exchange (LME) nearly quadrupled in just three trading days, threatening to put several clearing members into default and exhaust the default fund at LME Clear, its central counterparty (CCP). The LME responded in an unprecedented fashion, by canceling eight hours of nickel market trades. Though challenged in court, its authority to do so was ultimately upheld. This paper documents the market stress and LME’s response to understand the implications of the trade cancellation decision for financial stability and CCP powers going forward. While LME’s trade cancellation helped to alleviate distress, its decision lies in tension with the function of a CCP, which is to ensure contract performance. In upholding LME’s right to void contracts, the court’s verdict could change how CCP rulebooks are applied under financial distress, potentially creating scope for moral hazard or other adverse consequences.

Keywords: central counterparty, trade cancellation, default waterfall

JEL Classifications: G10, G23, K22