What’s at Stake? Understanding the Role of Home Equity in Flood Insurance Demand

Published: July 24, 2024

The effect of increasing flood risk on delinquencies and defaults in the mortgage system will depend on whether homeowners choose to buy flood insurance. This paper studies how home equity affects the demand for flood insurance. It finds that higher home equity increases flood insurance take-up. Given that many lenders do not require flood insurance, this finding points to an important driver of low flood insurance take-up (Working Paper no. 24-06).

Abstract

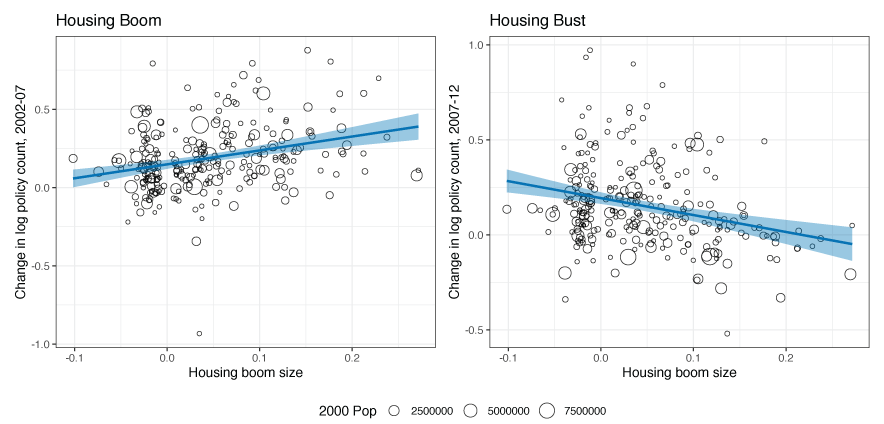

The consequences of climate change will depend on homeowners’ incentives to man-age their risk. We show that low home equity distorts borrowers’ demand for flood insurance by shifting their risk to lenders and federally backed mortgage purchasers. To isolate the causal effect of home equity on disaster insurance demand, we study flood insurance take-up over the housing boom and bust across markets with different price dynamics. Insurance take-up follows rising and falling home equity. Mechanism tests suggest that mortgage default acts as implicit insurance for borrowers with low home equity. Consequently, leveraged households do not fully internalize their climate risk.

Keywords: climate risk, disaster insurance, household finance, home equity, housing cycles, implicit insurance

JEL Classifications: G52, G21, Q54