Measuring the Unmeasurable: An Application of Uncertainty Quantification to Financial Portfolios

Published: October 1, 2015

Uncertainty is a crucial factor in financial stability, but it is notoriously difficult to measure. This working paper extends techniques from engineering to quantify fundamental economic uncertainty, and applies the method to an example of portfolio stress testing. By this measure, uncertainty peaked in late 2008. (Working Paper no. 15-19)

Abstract

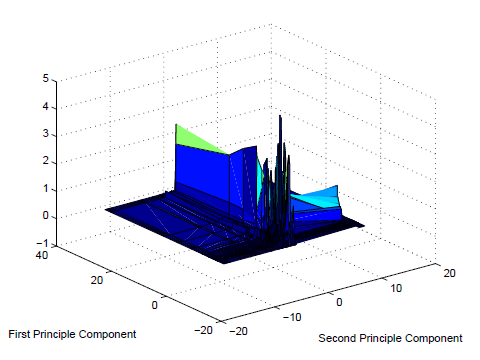

We extract from the yield curve a new measure of fundamental economic uncertainty, based on McDiarmid’s distance and related methods for optimal uncertainty quantification (OUQ). OUQ seeks analytical bounds on a system’s behavior, even where the underlying data-generating process and system response function are incompletely specified. We use OUQ to stress test a simple fixed-income portfolio, certifying its safety—i.e., that potential losses will be “small” in an appropriate sense. The results give explicit tradeoffs between: scenario count, maximum loss, test horizon, and confidence level. Unfortunately, uncertainty peaks in late 2008, weakening certification assurances just when they are needed most.