Crash Narratives

Published: December 28, 2023

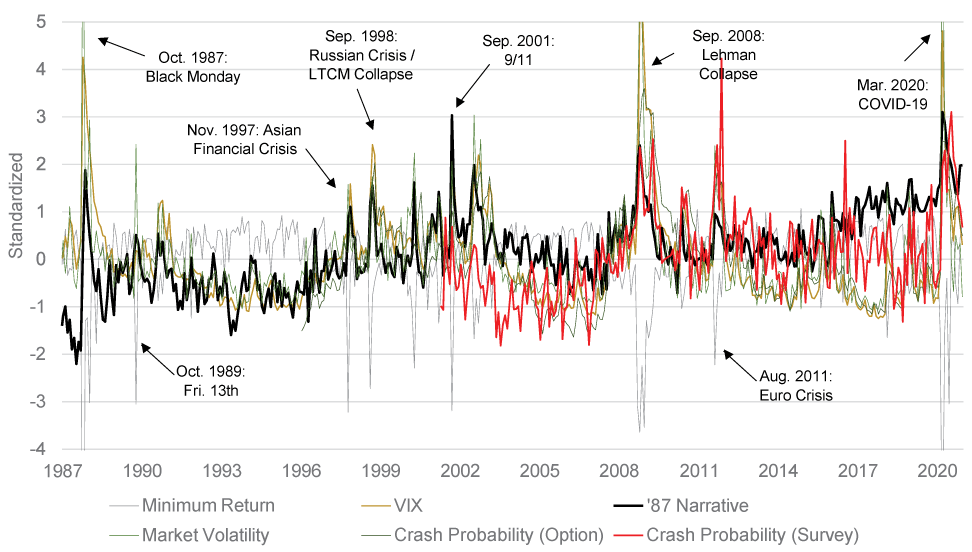

The financial press is a conduit for popular narratives that reflect collective memory about historical events. Some collective memories relate to major stock market crashes, and investors may rely on associated narratives, or crash narratives, to inform their current beliefs and choices. Using recent advances in computational linguistics, we develop a higher-order measure of narrativity based on newspaper articles that appear following major crashes. We provide evidence that crash narratives propagate broadly once they appear in news articles and significantly explain predictive variation in market volatility. We exploit investor heterogeneity using survey data to distinguish the effects of narrativity and fundamental conditions and find consistent evidence. Finally, we develop a measure of pure narrativity to examine when the financial press is more likely to employ narratives (Working Paper no. 23-10).

Abstract

The financial press is a conduit for popular narratives that reflect collective memory about historical events. Some collective memories relate to major stock market crashes, and investors may rely on associated narratives, or crash narratives, to inform their current beliefs and choices. Using recent advances in computational linguistics, we develop a higher-order measure of narrativity based on newspaper articles that appear following major crashes. We provide evidence that crash narratives propagate broadly once they appear in news articles and significantly explain predictive variation in market volatility. We exploit investor heterogeneity using survey data to distinguish the effects of narrativity and fundamental conditions and find consistent evidence. Finally, we develop a measure of pure narrativity to examine when the financial press is more likely to employ narratives.

Keywords: Narrative Finance, Crash Beliefs, Investor Surveys

JEL Classifications: E03, G00, G02, G11, G23